In this interview with Stefan Bosshard, Head Fixed Income at SDX, we explore the evolving landscape of digital bond issuance. Stefan discusses the integration of traditional and digital market infrastructures, the role of Distributed Ledger Technology (DLT) in enhancing transparency and automation, specific initiatives SDX is pursuing to innovate in the digital bond space, and the potential of digital bonds to attract new issuers and investors.

Hi Stefan! How do you see digital bond issuance evolving towards a model that combines the digitization of existing securities with the adoption of digitally native securities1?

One of our primary objectives is to facilitate seamless integration between the digital and traditional market infrastructures. This involves ensuring that SDX is effectively connected to the existing SIX infrastructure, allowing for the smooth transition of assets between both. By establishing this connectivity between SDX and SIX, we enable the availability of native digital assets in the traditional market, as well as the tokenization of traditional bonds, making them available for trading with atomic settlement1 in the digital world. Imagine the potential of settling trades of traditional bonds atomically, possibly against a wholesale CBDC. Such transactions could not only be incredibly fast but also among the safest in the market/industry of its kind. It’s important to note that the prefunding of such transactions adds complexity to the process, yet potentially making the market even safer. The evolution of markets and participant preferences for different asset classes will ultimately determine the appeal of each infrastructure.

How could the use of Distributed Ledger Technology (DLT) enhance transparency and automation in digital bond transactions, and what impact does this have on market participants?

Distributed Ledger Technology potentially allows for unprecedented transparency into trading behaviour, even within private transactions within the SDX network. This means that custodians can securely track bond movements and ownership changes, providing greater insight and confidence to market participants.

Furthermore, DLT could facilitate automation through the utilization of smart contracts. These contracts, which are self-executing functions with predefined rules, can automate various aspects of bond transactions, including issuance, coupon payments, and redemption. By eliminating manual processes, issuers can achieve greater efficiency and accuracy in their operations. In fact, with the potential for the entire lifecycle of bond transactions to be automated on the DLT, market participants stand to benefit from streamlined processes and reduced operational overhead.

Overall, the use of DLT in digital bond transactions not only enhances transparency and automation but also has a transformative impact on market participants, empowering them with greater visibility, efficiency, and confidence in their transactions.

Can you highlight any specific initiatives or projects that SDX is exploring to further innovate in the digital bond space?

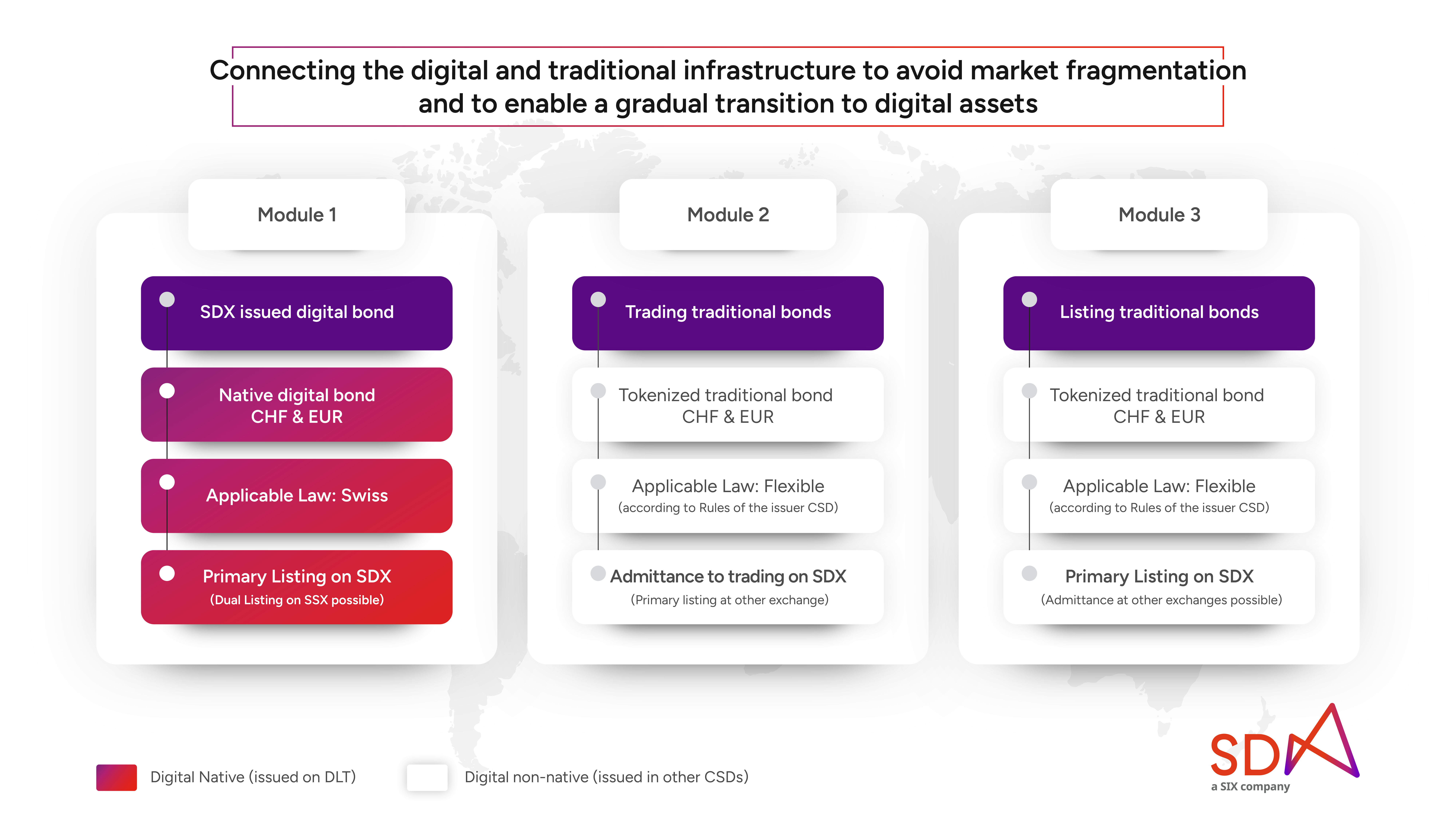

SDX is actively pursuing various initiatives to drive innovation in the digital bond space. We currently have three dedicated modules live:

- Module 1 focuses on issuing and listing digital native bonds on SDX under Swiss law, tokenized in CHF and EUR.

- Module 2 enables the trading of traditional bonds on SDX that are issued in other Central Securities Depositories (CSDs) and admitted to trading on our Exchange. These bonds can settle atomically in the SDX CSD against tokenized CHF and EUR, even if issued under non-Swiss law.

- Module 3 allows for the listing of traditional bonds on SDX that are issued in other CSDs. These bonds could theoretically trade on our Exchange and settle in our CSD against tokenized CHF and EUR. Moreover, they may also be issued under non-Swiss law.

In addition, SDX is currently engaged in an ongoing pilot known as Project Helvetia Phase III. This groundbreaking pilot involves the Swiss National Bank (SNB) issuing real wholesale Central Bank Digital Currency (wCBDC) in Swiss francs on SDX’s distributed ledger technology (DLT)-based financial market infrastructure. This marks a significant transition from test environments to production, making wholesale CBDC available for the settlement of real bond transactions. Banks participating in Project Helvetia Phase III act as intermediaries for issuers and investors, with tokenized bonds settling against wholesale CBDC on a delivery-versus-payment basis.

Do digital bonds attract a new class of issuers and investors?

Digital bonds are currently similar to traditional bonds, yet they offer unique opportunities. Bonds issued in SDX are accessible to the entire CHF investor base, facilitating the gradual transition to the digital model that underpins the future financial market. This accessibility, coupled with the integration of tokenized cash for on-chain atomic settlement of digital assets, is driving further automation and unlocking new use cases through “programmable money.” As a result, digital bonds have the potential to attract a new class of issuers and investors, shaping the landscape of bond markets in the process.

Thank you, Stefan!