SDX is a fully regulated digital infrastructure platform that leverages blockchain technology to support the entire bond lifecycle. From issuance to settlement, SDX ensures secure, transparent, and efficient processes.

Our strong focus on regulatory compliance creates a trusted environment for digital bond transactions. We collaborate closely with regulators to uphold high standards of integrity, investor protection, and market stability.

By choosing SDX for digital bond issuance, organizations benefit from streamlined capital raising, improved liquidity, and the operational advantages of blockchain - all within a regulated framework designed to support growth and innovation.

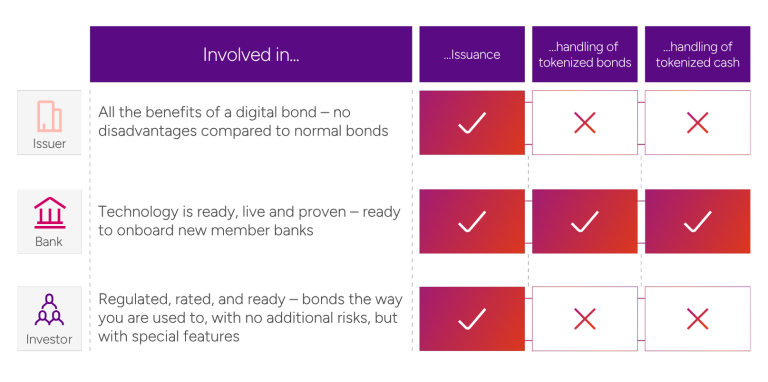

Our Central Securities Depository (CSD) runs on Distributed Ledger Technology (DLT), which is the heart of the digital market infrastructure of the future. While drawing from elements seen in the crypto world, this system presents distinct nuances. It’s fully regulated by the Swiss Financial Market Supervisory Authority FINMA, and it operates on a private permissioned network and a need-to-know basis for its members, such as banks and securities firms. It also ensures backwards integration to the existing market infrastructure by SIX Group. So that syndicate banks together with their clients can issue native digital bonds based Swiss securities law that can also live in the traditional world. Digital bonds can settle against tokenized CHF on chain, where they are securely stored in cryptographic wallets for end investors.

SIX Digital Exchange is playing a significant role in this transformative journey. As the digital bond market evolves, it has the potential to diversify investor bases, introduce innovative features, and create a more efficient ecosystem. While challenges remain, the progress made by SDX, and other market participants signals a promising future for adopting digital bonds in the financial landscape.

One notable advantage of digital bonds in the EUR-denominated bond market is the mitigation of settlement risks. In this market, trades are typically settled bilaterally without involving central counterparties. By leveraging the platform’s instant settlement capabilities, counterparties can transfer bonds with each other, even if they are unknown to one another, without facing settlement risks. This is a significant improvement made possible by the technology and can bring greater efficiency and security to the market.

Get in touch so we can demo our platform and show our services in more detail.